Fast Moving Consumer Goods

FMCG Industry in India:

The fast-moving consumer goods (FMCG) segment is the fourth largest sector in the Indian economy and is estimated to grow from US$ 30 billion in 2011to US$ 74 billion in 2018.Broadly classified into three categories- Packaged Food or Food & Beverages, Personal Goods and House Care Products,food products are the leading segment, accounting for 43per cent of the overall market.Personal Care (22 per cent) and Fabric Care (12 per cent) come next in terms of market share.

Size of Counterfeit FMCG Market in India

Measuring the exact size of counterfeiting in the FMCG industry is methodologically challenging for various reasons. However, according to various media reports it is estimated that the FMCG sector lost 30 percent of its business to fake products and 80 per cent of consumers who purchased these products believed that they had bought originals. Further, according to a study by FICCI CASCADE in 2013-14, the estimated loss of sale to the FMCG industry was approximately (INR 21957+INR19,243 crores).

Factors responsible for increase of illicit trade in FMCG products.

In the FMCG sector, counterfeiters take advantage of and use advanced technology to imitate original products and replace them with inferior substitutes.These could be contrabands or look-a likes passed off as original products.There could be various factors driving the illicit trade in the FMCG sector, however, the key reasons seem to be as follows:

- A large unorganized sector in the packaged food industry.

- Weak regulatory and implementation mechanism.

- High price of branded and premium products.

- Huge income disparities creating a market for cheap alternatives to the branded and premium products among the low-income population.

Impact of counterfeiting in FMCG sector

Counterfeit goods can be dangerous and potentially harm or even kill unsuspecting consumers. These products may contain hazardous and untested ingredients and cannot assure safety or efficacy. Apart from the health and safety issues, counterfeit products in the market mean low satisfaction or benefits to the consumers and poor value for their money.

Impact on Consumers

A recent study by the Delhi Institute of Pharmaceutical Sciences and Research (DIPSAR) found that many of the toothpaste manufacturers are adulterating toothpaste and tooth powders with a high quantity of nicotine.Out of 24 well-known brands of toothpaste examined, which were produced and marketed by leading FMCG companies, seven were found to contain nicotine,which is expressly banned as the Cigarettes and Other Tobacco Products Act, 2003, prohibits the use of tobacco in any non-tobacco product. Similarly, out of 10well-known 23 tooth powders,six contained nicotine. The most remarkable aspect of these findings was that the companies involved were leading national and international brands of the FMCG world. Similar cases have been reported from Mumbai and Ahmedabad in which nearly half of all cosmetic and beauty care products sold over the counter (OTC) were found to be fake or spurious and more than half contained harmful ingredients. Ayurvedic products manufactured by some FMCG giants were also found to have misleading information about the ingredients.

Impact on Government

Any counterfeiting activity,whenever it takes place, is bound to impact the Government heavily.Globally, the government loses billions of dollars in tax revenue due to counterfeit and smuggled products. Coupled with the costs incurred in judicial proceedings and various associated law enforcement agencies, the effort and cost entailed by the various government bodies to seize these goods in gruelling. In totality,Government loses tax, incur higher expenditure on public welfare,insurance, and health services as well as consumer distrust, loss of country image and reputation.

Impact on Industry

Manufacturers are hit badly by illicit trade. In addition to revenue losses, many other things at stake due to counterfeiting. Some of these include:

- Loss of trust, good will & brand image: Consumers lose their trust in the manufacturer after buying a fake product unknowingly. For a brand, years of hard work spent in brand-building is lost due to a single incident of fake or counterfeit activity.

Curtail Innovation: Increasing the magnitude of counterfeited and smuggled goods discourage companies to invest and deploy resources in product innovation. According to the FICCI study, the FMCG sector is spending little on innovation. The lack of new copyrights, trademarks, or patents in this industry, could be attributed to the fear of lower returns on investments by legitimate manufacturers due to counterfeiting and the growing illicit markets.

Loss of Sales: The grey market percentage in the FMCG-personal goods industry increased from25.9 per cent in 2010 to 31.6per cent in 2012. Loss to the industry also increased to 19,243 crores in 2014 from 15,035 crores in 2012,attributable to the increase in the industry size as well as grey market percentage.

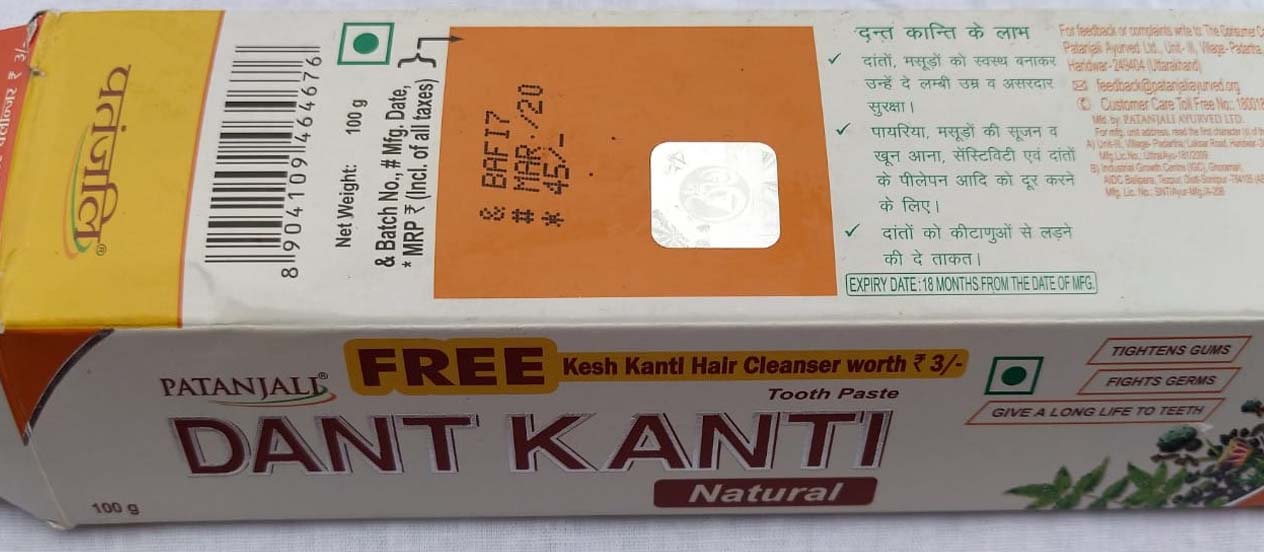

Counterfeiters today are tech-savvy and can easily produce packaging material similar to or better than that of genuine products. But, if there is a problem, there are solutions. Technology-based solutions could be one of the strategies to counter the problem. The proven adoption of these technologies by various brand like Patanjali, Mother Dairy and Amul can be treated as case studies. These authentication solutions have multiple benefits as they provide b) Product authentication and c) Tracking and tracing of the product. Some of the technological solutions that seem to have worked for the industry are listed below: