Alcohol & Beverages

Introduction

Illicit alcohol is prevalent in both developed and developing countries, with no country immune to this threat. Every year, exchequer & industry loses billions of revenue because of this. For example, the UK Govt. lost GBP 1.3 billion in excise tax revenue in the period 2015-16, Dutch Authorities estimate annual revenue losses from illicit trade in alcohol at EURO 100 million. Liquor bootlegging in New York City alone is estimated to have cost the city $ 1 billion in lost taxes over the past 15 years. Given the Indian scenario, the illicit market in alcohol is growing at a large pace. According to the FICCI-CASCADE study, the alcohol industry lost Rs 14,140 crore in 2014, while the Government lost tax revenue worth Rs 6309 crore.

Impact

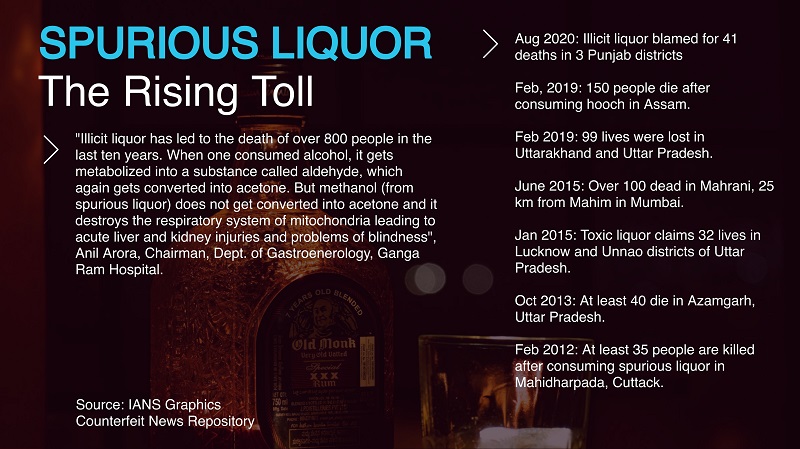

While the industry & Govt. loses revenue, it is the consumer who is impacted mostly as illicit liquor poses a serious threat to consumer health and life. Poor quality or spurious liquor can cause death and serious illness, as seen in connection with several unfortunate incidents of hooch tragedies in India. As per estimates, more than 250 people died in India due to hooch tragedies in the year 2019.

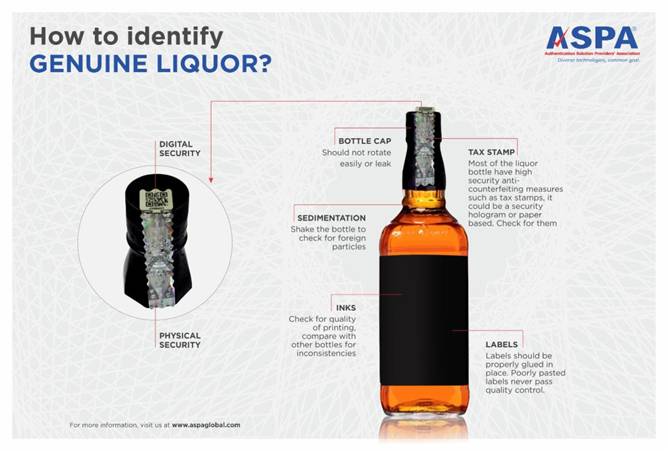

The illicit alcohol products are sold as either counterfeit of genuine brands or are unlabeled. When producing counterfeits, the forgery goes beyond the product’s label, often including bottle designs and caps. Mostly, these counterfeits / illicit alcohol products are either produced by manufacturers that don’t comply with rules & regulations, suppliers of empty bottles & intermediaries with bars and clubs.

The common challenges industry is facing such as:

- Combating counterfeiting, illicit, smuggling & parallel markets: A significant proportion of the alcoholic drinks in India, are produced illicitly by the informal sector or consists of “Second or D Market” (tax evaded beverages) and therefore remain undocumented. There is also a considerable volume of smuggling of alcoholic beverages, especially scotch into the country. Since no government revenues are paid, illicit liquor is sold at a low price which causes hooch tragedy. Although it has been speculated that such unrecorded consumption may be as much as 45 percent of all users, there is very little recent data in this regard. Evidence that such use is widespread is evident in the regular occurrence of poisoning (hooch tragedies) following drinking spurious liquor, often on a mass scale. While brands will be more focused on preventing counterfeits, Smuggling is a problem of State Excise Departments.

- Secure revenue generated from tax collection: Revenue from excise duties on alcohol has always become a significant contributor for many States in India accounting for more than 10 percent of their tax revenue. Under the Indian constitution, liquor is one commodity which the States are entitled to charge excise duty (Article 246). The revenue from excise duties was the second-largest source of income for States after Sales Tax.

- Ensure consumer confidence & identification: The hooch tragedies that occur due to illicit liquor consumption eroded the image of state governments which create challenges for the state government to ensure consumer confidence.

There are other challenges such as complying with regulations, enforcement coordination, ensuring fool-proof labelling, monitoring the integrity of the supply chain, etc.

Regulation & Recent Development

In Indian, scenario liquor is a State Policy matter. Both State Excise Department & Brand owners face various challenges. At the Government level, State Excise Department, not only has to strike a delicate balance between the twin objectives of preventing dominance of liquor mafia or social degeneration on the one hand and securing an optimum revenue for the Government on the other but also must address the concerns of all the four key stakeholders i.e., the Government, the Manufacturers, the Licensees and most important of all, the Consumers. In the liquor industry, both brands and Government share the equal opportunity of ensuring consumers that whatever they are buying is genuine, although, the Goodwill of State stake is always high.