Cigarettes & Tobacco

What is Illicit Tobacco Trade?

Illicit tobacco trade refers to any practice related to distributing, selling, or buying tobacco products that are prohibited by law, including tax evasion, counterfeiting, disguising the origin of products, and smuggling. Illicit trade can be undertaken both by illicit players who are not registered with relevant government agencies, and legitimate entities whose business operations are contrary to applicable laws and regulations. Unsurprisingly, the illegal nature of tax evasion makes the task of measuring its scale extremely difficult. The recent consensus among experts estimates the annual revenue loss in tobacco taxation worldwide at US$40–50 billion, that is, about 600 billion sticks (individual cigarettes), or 10 percent of consumption.

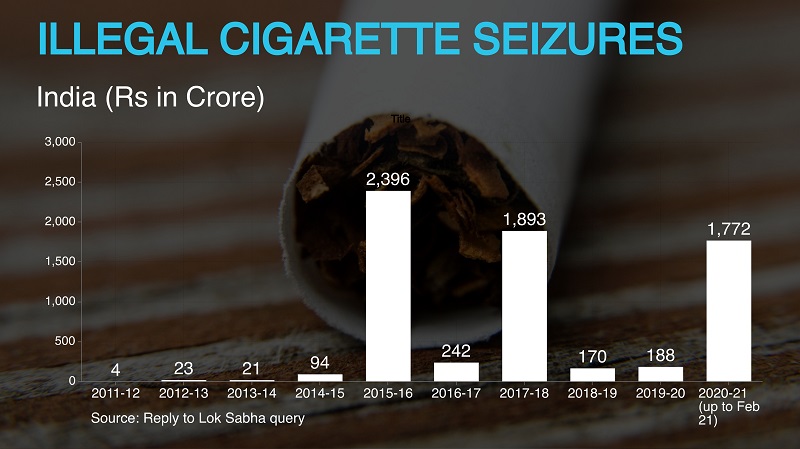

Magnitude of Problem in India: In India, legal cigarettes constitute only 10 percent of the total tobacco consumption. Other tobacco products like chewing tobacco, bidis, and gutkha, etc. comprise the rest of the 90 percent when considered in volume terms. In the last three decades, the legal cigarettes’ share amongst total tobacco consumption in India has declined from 21 percent (1981-82) to 10 percent in 2016-17. During the exact period, the overall tobacco consumption within the country has increased by 33 percent. The entire tobacco market (including all tobacco products) produced in India (either factory, home or unorganized units) is estimated to be around Rs 1,44,000 crores in 2015. Due to various factors, illegal smokes have grown rapidly and now account for 1/4th of the Cigarette Industry in India, causing an annual revenue loss of Rs.13,000 crores to the exchequer.

Impact of Illicit Tobacco Trade

Illicit trade in tobacco products contributes to numerous health, economic, and governance challenges. Nevertheless, the following are salient.

- Impact on Public Health – Illicit tobacco kills: The fundamental reason to confront illicit trade in tobacco products is that it entails public health impact. All tobacco products are harmful to human health, even if they are produced and marketed legally. Nevertheless, illicit tobacco harms individual and population health in additional ways. From a public health perspective, illicit trade weakens the effect of tobacco excise taxes on tobacco consumption – and, consequently, on preventable morbidity and mortality by increasing the significance, attractiveness, and access to tobacco products. It has been estimated that the illegal cigarette market reduces average cigarette prices by about 4 percent and is accountable for about 2 percent higher cigarette consumption. If the global illicit trade were eliminated, in just six years, over a million lives would be saved.

- Impact on Society & Youth: Illicit trade makes tobacco products more affordable and accessible to individuals from low-income groups, as well as children. These products are being sold at prices that were lower, thus increasing consumption. According to reports, the average street price of cigarettes was 50 to 60 percent lower in comparison to taxation paid cigarettes. Cost and tax policies are recognized as among the most efficient way of reducing demand for and consumption of tobacco goods. Nevertheless, the illegal trade undermines tax policies, facilitates the uptake of tobacco use among youth, and increases health inequalities inside the society.

- Impact on Government: Illicit trade siphons tax revenues away from governments, which subsequently decrease the capability of authorities to provide decent governance. It also reduces the allocation of resources for socioeconomic development, particularly in low-income nations that rely on consumption taxes. The recent consensus among experts estimates the yearly loss of income from tobacco taxation globally at US$ 40-50 billion, that’s about 600 billion sticks or 10 percent of consumption. The illicit tobacco trade sponsors criminals and funds organized crime. These include drugs, human and arms trafficking, and armed insurgent groups with a possible impact on the general level of corruption and security. In contrast, confronting illegal trade in tobacco products can strengthen taxation administration, compliance, and enforcement. Controlling illegal trade in tobacco products and overall governance is mutually reinforcing.

- Uncontrolled illicit trade in tobacco provides opportunities for the tobacco industry to misinform public opinion and unduly influence public policy: The tobacco industry uses inflated prices of the impact of tobacco taxes on illegal trade to campaign against tobacco tax increases and misinform public opinion. By accurately measuring and better controlling the illegal tobacco trade, authorities reduce the industry’s capability to distort coverage.

Causes behind illicit tobacco trade

Contributing factors to illicit trade are complicated. Nevertheless, contrary to tobacco industry arguments, taxes and prices only have a limited impact on the illicit cigarette market share at the country level. Evidence suggests that the illicit cigarette market is relatively larger in countries with low taxes and prices while relatively smaller in nations with high cigarette taxes and prices. Non-price factors such as governance status, weak regulatory framework, social acceptance of trade, and the availability of informal distribution networks seem to be far more significant determinants of the size of the illicit tobacco industry. Measures controlling the illicit tobacco market are an essential component of a well-designed tobacco control policy. The amount of government effort to combat illicit trade in tobacco products will be motivated both by the possible tax revenue profit and from general health gains due to lower tobacco usage. Since illicit trade in tobacco products is determined by multiple factors, an effective strategy to address this issue would need to be explicitly multi-sectoral, involving all relevant agencies of government. Preferably, ministries of finance, trade, industry, foreign affairs, justice, interior, customs, education, and wellness are going to be involved, in addition to civil society and the media. Vested interests of key stakeholders and public opinion concerning illicit tobacco trade can help determine the amount of tax evasion and, consequently, also need to be examined. Prioritizing and coordinating control of the whole distribution chain (from the areas at which tobacco leaves are grown, or the port of entry, to the final purchase by the respective consumer) and enforcement of tobacco regulations have proven to be effective measures in reducing tax evasion with the consumption of tobacco products.

Categories of illicit tobacco trade

Tobacco and cigarettes lend themselves to a set of Customs and Excise fraud typologies, both in terms of legitimately manufactured cigarettes and illicit cigarettes. The following fraud typologies make the analogy with distinct internal excise and VAT regions. These fraud types can occur in both the original country of manufacture, at the border and post-border.

Table: Summary of Tobacco Fraud Archetypes

| Fraud Archetype | Definition |

|---|---|

| Illicit Manufacturing | Illicit Manufacturing in which a product bears a trademark without the right Holders’ consent. Illegally manufactured products can be sold in the source country or smuggled into another country. Excise Tax is rarely if ever, paid on counterfeit and on unlicensed manufacturing. |

| Transit Fraud and Ghost Exports | Product declared for in-transit removal to country B but kept in country A and sold in the local market. This includes acquittal fraud, which happens when documentation is provided that falsely indicates that the product has been exported (referred to as a ghost export), with the product having been sold in the local market. This may allow an unlawful reclaim or non-payment of excise duty and non-payment or refund of the VAT. |

| Diversion | Products are declared for consumption in one country (with taxes and duties often legitimately paid in that country), to illegally move the products into another territory where taxes and duties would otherwise be higher. |

| Illicit Whites /cheap Whites | Brands manufactured legitimately in one market, either taxed for local consumption or untaxed for export and sold knowingly to traders who transport them to another country where the products are sold illegally without domestic duty paid. |

| Mis-Declaration | Mis-declaration of tariff code to attract a lower rate of duty, or to avoid undue scrutiny of the consignment or misdeclaration of the end destination. |

| Round Tripping | Cigarettes are legally exported to country B and then smuggled back into country A to be sold on the local market illegally, to avoid paying VAT and Excise Duties on sales in the local market in Country A. |

| Smuggling | The movement of goods across a Customs frontier in any clandestine manner, evading Customs control. Non-declaration (where no product is declared at the port of entry) is also a form of smuggling. |

| Undervaluation | Typically, incorrectly declaring weight, quantity or value, and invoices differing from the bill of lading, to minimize the payment of import duty and VAT. |

| Under the Declaration of Production Volumes | Legitimate manufacturer under-declare production volumes, siphoning off some of their products and selling the cigarettes off the books, to avoid paying excise duties, VAT, and subsequently income tax. |

Measures Countries adopting to confront illicit trade in tobacco products?

Experiences in many countries, states, and other jurisdictions demonstrate that a comprehensive approach to address illicit tobacco markets is most effective. The table highlights the approaches to addressing illicit trade taken by a selection of countries. As with other tobacco control strategies, most of these actions would be most effective as part of a comprehensive approach rather than as individual interventions. A comprehensive approach refers to an approach that includes enhanced coordination, enforcement, and penalties at all levels of government, and the set of measures in the highlight box below.

Table: Few Measures to Control the Supply of Illicit Tobacco Products

| Approach | Definition |

|---|---|

| Licensing | Official authorization for engaging in any activity within the tobacco supply chain, from tobacco growing to product manufacturing to product transportation, wholesale, retail, and the import/export of tobacco products. It motivates the licensees to follow legal business practices under the threat of losing the license. Linking licensing systems with product markings/stamps, recordkeeping, and a tracking and tracing system makes it more effective. Licensing producers and distributors of acetate tow, cigarette papers, and manufacturing equipment needed to produce tobacco products could control illegal manufacturing. |

| Product markings/ stamps | Counterfeit-resistant, affixed images on product packaging that indicate at least date and location of manufacture, manufacturing facility, and product description. They should have both overt and covert security features. Markings/stamps serve up to three functions for any party in the supply system and the final buyer: a product authentication tool, a tracking/tracing tool, and a revenue collection tool. They are particularly helpful in identifying products on which taxes have been paid. They are usually applied to both domestic and imported products, but also to export if appropriate. |

| Track-and-trace | Systems combining markers with a national record-keeping structure to enable tracking of tobacco products throughout the supply chain, authentication, and tracing the movement of products by consulting the tracking data kept in a national information-sharing database. The system involves systematic, real-time accounting of all products, random serialization, aggregation, and monitoring of the product's movement through the supply chain. It aids crimeprevention and facilitates investigations by identifying where the originally legal products were diverted into illicit channels. The system is less effective in controlling illegal manufacturing facilities or counterfeits, even though it increases the distribution costs of such products and aids their detection in the retail environment. |

| Eliminating loopholes/ exemptions in the tax law | Sales occurring via virtual channels (e.g., internet, mail, phone) needs to be subject to the appropriate taxes. Eliminating exemptions from tax payments or managing exemptions in a way that prevents their misuse by those involved in the illicit tobacco trade. These include, for example, policies addressing sales in territories exempt from taxes and in duty-free shops |

| Due diligence | Requiring parties engaged in the supply chain of tobacco, tobacco products, and manufacturing equipment to exercise due diligence in conducting business, including proper identification of customers, monitoring sales to these customers, and reporting any suspicious activities that could result in law violation. |

| Record keeping | Requiring all parties engaged in the supply chain of tobacco, tobacco products, and manufacturing equipment to maintain complete and accurate records of all relevant transactions such as acquiring materials used in production, intended markets of retail sale and their volumes, the intended shipping routes, volumes kept in stock, under the transit regime or in duty suspension regime |

| Supportive legal environment | Adopt legislation that clearly defines unlawful conduct related to the supply of tobacco products, determines what constitutes administrative, civil, and criminal offences, and establishes liabilities for such conduct. |

| Penalties | High/escalating fines, license revocation, or other measures that can be aimed at retailers, consumers, and other participants in illicit trade to deter this activity. |

| Public awareness | Dissemination of information about the consequences of engaging in the illicit tobacco trade. Educating the public about how to distinguish legal from illegal tobacco products. Dissemination of information about the impact of illicit tobacco trade on society, including easier access to tobacco products by youth, lost revenue, and support for other illegal activities. Avoid the "illegal cigarettes are more harmful" message since it can promote legal tobacco products. |

In September 2018, the WHO FCTC Protocol to Eliminate Illicit Trade in Tobacco Products entered into force. By providing comprehensive norms and a framework for global cooperation, the Protocol provides countries with a game-changing opportunity to advance progress against tobacco-related morbidity and mortality by challenging the illicit tobacco trade. By seizing the opportunity and intensifying action against illicit trade, in line with the Protocol, countries can harness increasing political momentum, forge global and regional partnerships for collaboration and knowledge sharing, and score decisive victories against illicit trade in tobacco in the years ahead. To fully benefit from the Protocol, policymakers and implemxenters now seek to connect its normative guidance with empirical data and analysis on countries’ illicit trade in tobacco control experiences to date—what has worked, what has not worked, and why.

| Approach / Implemented | Turkey | Hungary | Canada | Brazil | Malaysia | Italy | UK |

|---|---|---|---|---|---|---|---|

| Licensing | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Markers | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| National record keeping | Yes | Yes | Yes | Yes | Yes | Yes | |

| Track & Trace | Yes | Yes | Yes | Yes | |||

| Enforcement | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Tax harmonization | Yes | Yes | Yes | Yes | |||

| Agreements with industry | Yes | Yes | Yes | Yes | Yes | ||

| Public awareness | Yes | Yes | Yes | Yes | Yes | ||

| Agencies co-ordination | Yes | Yes | Yes | Yes | Yes | Yes | |

| WHO FCTC: year ratified | 2004 | 2004 | 2004 | 2005 | 2005 | 2008 | 2004 |

| WHO FCTC protocol to eliminate illicit trade in tobacco Products: year signed / year of accession | 2013 | 2013 |